Understanding International Tariffs

International tariffs are taxes imposed by a government on goods and services imported from other countries. These tariffs are a vital component of global trade systems, acting as both regulatory tools and sources of revenue. Countries utilize tariffs for various reasons, including the protection of domestic industries from foreign competition, the generation of government revenue, and the alteration of trade balances in favor of local economies. In essence, international tariffs can significantly influence the flow of goods between nations and the overall economic landscape.

One of the primary motivations for implementing tariffs is to shield local industries from overseas competitors. By taxing imported goods, governments can make these products more expensive, thus encouraging consumers to purchase local alternatives. For instance, if the United States imposes a tariff on imported steel, American steel manufacturers may benefit as their products become relatively cheaper for consumers compared to the foreign steel. This protective measure aims to promote domestic production and preserve jobs within affected industries.

Another reason for imposing tariffs is to generate revenue for the government. This is particularly pertinent for developing countries that may rely on import duties as a critical source of income. Tariffs provide a straightforward way for these governments to collect funds needed for public services, infrastructure, and development projects. For example, a country might impose a 10% ad valorem tariff on all cloth imports, directly impacting the price paid by consumers while bolstering the national budget.

There are different types of tariffs, including specific tariffs and ad valorem tariffs. Specific tariffs are fixed fees levied on a particular quantity of goods, such as a $100 charge per ton of imported sugar. In contrast, ad valorem tariffs are based on a percentage of the good’s value, like a 15% tax on the price of imported automobiles. Both types serve the dual purpose of regulating trade and generating government revenue, showcasing the multifaceted role of international tariffs in facilitating global commerce.

The Role of Tariffs in U.S. Trade Policy

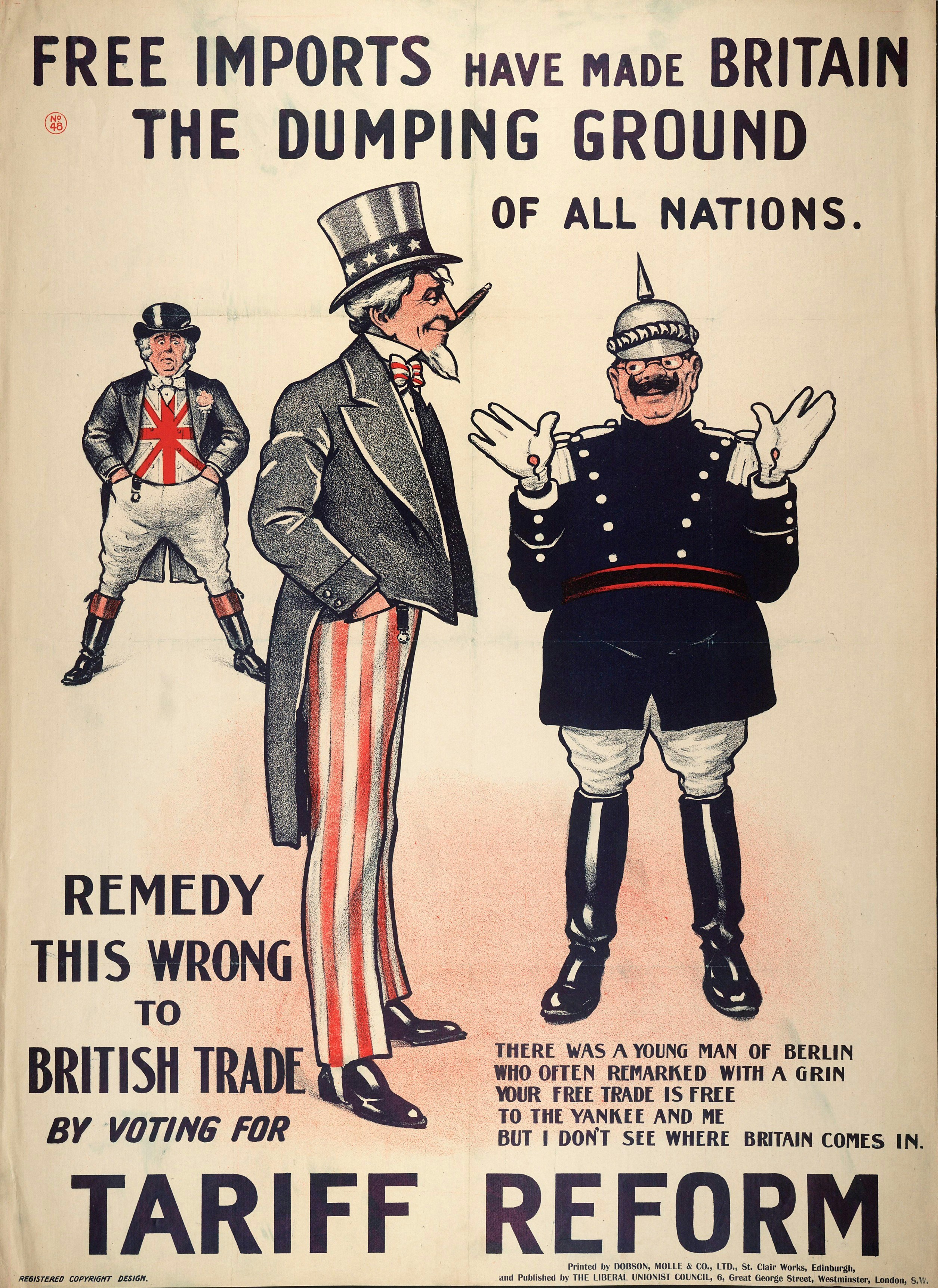

Tariffs have played a significant role in shaping U.S. trade policy throughout the nation’s history. Established as a tool for economic protection and revenue generation, tariffs emerged prominently in the early 19th century, particularly with the Tariff of 1816, which aimed to protect burgeoning American industries from foreign competition. Over the years, several important pieces of legislation, including the Smoot-Hawley Tariff Act of 1930, enforced some of the highest tariffs in U.S. history, intended to shield domestic markets amid the Great Depression. Such legislative measures have often ignited debates about their efficacy, leading to fluctuations in implementation and adjustment.

In recent years, tariffs have resurfaced as a focal point in trade negotiations, particularly during periods of geopolitical tensions and economic uncertainty. Under the Trump administration, tariffs were imposed on steel and aluminum imports, as well as a series of tariffs targeting Chinese goods, which were designed to bolster American manufacturing and protect jobs perceived to be at risk from foreign competition. This shift reflected a growing inclination toward a more protectionist stance within U.S. trade policy, raising questions about the broader implications for international relationships and commitments to trade agreements.

The impact of these tariffs on the American middle class remains a topic of considerable debate. Proponents argue that protecting domestic industries enhances job security and wages, which is beneficial to middle-class households. Conversely, critics highlight that higher tariffs can lead to increased consumer prices and retaliatory measures, ultimately affecting the purchasing power of the middle class. These conflicting perspectives underline the complex relationship between tariffs and American economic well-being, reinforcing the idea that while tariffs may aim to safeguard domestic interests, their ripple effects often extend beyond initial intentions.

Economic Effects of Tariffs on the Middle Class

The imposition of international tariffs can have profound economic consequences for the American middle class, significantly impacting their financial stability and purchasing power. Tariffs, by design, serve as taxes on imported goods, which can lead to inflated prices for everyday items. As these costs rise, consumers find themselves facing higher expenses for essential products such as electronics, clothing, and food. This increase in prices contributes to overall inflation, effectively eroding the purchasing power of the middle class. When individuals must spend more on the same goods, their disposable income diminishes, limiting their ability to save or invest.

Moreover, the economic implications of tariffs extend beyond consumer prices. The job market is also affected, as various sectors react differently to tariff policies. In certain industries, tariffs may provide temporary job protection by shielding domestic producers from foreign competition. However, this protectionist approach can lead to unforeseen consequences. Industries reliant on global supply chains—such as technology, automotive, and retail—may face job losses due to increased operational costs and disruptions in trade flows. Companies may be compelled to downsize or relocate manufacturing activities outside the United States, ultimately resulting in a net loss of jobs for middle-class workers.

The overall impact of these economic factors on living standards and economic security cannot be understated. While some segments of the middle class may benefit from job protection in tariff-impacted sectors, the broader implications often lead to a precarious balance. The anxiety around job security and fluctuating prices can create an environment of financial uncertainty, undermining the middle class’s quest for stability and growth. In this complex landscape, the interplay of tariffs and their associated economic effects poses significant challenges for the American middle class, warranting careful consideration and analysis.

Future Implications and Solutions

The ongoing discourse surrounding international tariffs is poised to significantly shape the economic landscape for the American middle class. As global trade dynamics evolve, it is crucial to consider the long-term implications of current tariff policies. Future developments may see heightened tensions in international relations that can lead to increased tariffs, further straining middle-class families who rely on affordable goods. Conversely, a shift towards more collaborative trade negotiations could result in reduced tariffs, benefitting consumers and the overall economy.

To address the potential adverse effects of international tariffs on the middle class, policymakers must explore a variety of solutions and reforms. One avenue is the implementation of more nuanced tariff structures that can be adjusted based on the economic impact on domestic industries while safeguarding consumer interests. This approach would ideally enable government bodies to respond swiftly to market fluctuations and diminishing conditions without entirely discouraging trade.

Moreover, initiatives such as targeted subsidies and support for industries disproportionately affected by international tariffs could alleviate some of the financial burdens faced by the middle class. By focusing on sectors integral to the domestic economy, strategies can be developed to ensure these industries remain competitive in the global marketplace while providing assurance to American workers.

Lastly, fostering a balanced trade approach is essential for supporting the middle class while promoting fair competition globally. It is imperative that the United States engages in trade agreements that prioritize equitable terms and mutual benefits, ensuring that the middle class does not bear the brunt of unbalanced tariffs. A cooperative, rather than confrontational, stance on international trade may pave the way for sustainable economic growth that ultimately benefits the demographic hardest hit by fluctuating tariff policies.